Estimating 2025 Texas Franchise Tax. Franchise tax returns can't have an accounting year end that is greater than january 4th. You may have to run the latest update if you receive an.

Franchise tax returns can’t have an accounting year end that is greater than january 4th. In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and.

In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and.

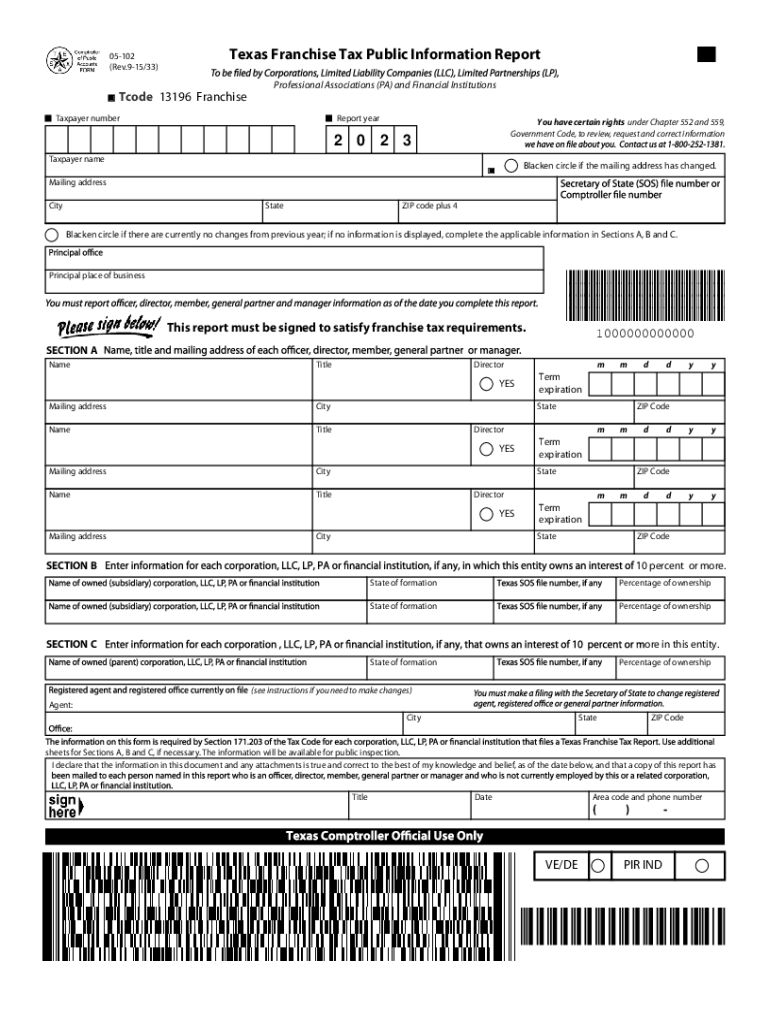

2025 Texas Franchise Tax Reporting Changes BSH Accounting, “no tax due” reports no longer required. Currently, the first $1.234 million of a business’s annual revenue are exempted from the franchise tax.

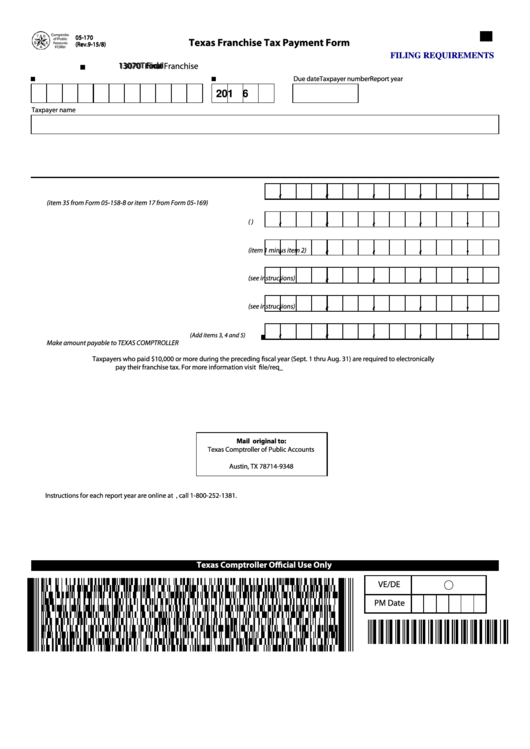

How To File Texas Franchise Tax Report, They—along with others that were previously under the $1 million threshold—will be relieved of the administrative burden and will no longer be required to. The texas franchise tax, which applies to most businesses operating in the state, will see changes to its rates in 2025.

How To Estimate Texas Franchise Tax, The texas tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in texas, the calculator allows you to calculate income. Are you a business owner or entrepreneur in the lone star state?

Texas Cost Estimate of Legislation Shows Impact of Franchise Tax Cut by, Texas franchise tax deadlines for 2025. November 7, 2025 · 5 minute read.

2025 Tax Brackets And Deductions Cody Mercie, For report years 2025 and 2025, most taxpayers with annualized revenue under. This year the state of texas changed its filing requirement so that we no longer have to file the no tax due reports.

2025 Tax Brackets Mfj Limits Brook Collete, Texas amends franchise tax apportionment rule with significant changes to sourcing provisions. November 7, 2025 · 5 minute read.

2025 Texas State Tax Calculator for 2025 tax return, The texas comptroller of public accounts has provided notice of the discontinuation of the no tax due report for the. Changes to texas franchise no tax due reports for 2025 | thekfordgroup.

Texas Franchise Tax 2025 2025, ★★★★★ [ 743 votes ] this page contains the tax table information used for the calculation of tax and payroll deductions in texas in 2025. For report years 2025 and 2025, most taxpayers with annualized revenue under.

Turbotax 2025 Estimator For Tax Filing Toby Aeriell, Are you a business owner or entrepreneur in the lone star state? You must file and pay the texas franchise tax by may 15, 2025.

Franchise Tax Texas Report 20222024 Form Fill Out and Sign Printable, In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and. Previously, businesses with no tax liability still had to file these.

The texas comptroller of public accounts has provided notice of the discontinuation of the no tax due report for the.

In july 2025, the texas legislature passed senate bill 3, which increased the no tax due threshold and.

Pga Championship 2025 Valhalla. The field is set for the 2025 pga championship, but who has qualified for the major…

2025 Honda Civic Si Hp. 18 in matte black alloy. Mpg ratings * (city / highway / combined) 27 /…

March 2025 Holidays And Observances. Explore inclusive observances and celebrate diversity this month. Jonquil, symbol of friendship, desire, forgiveness. International…