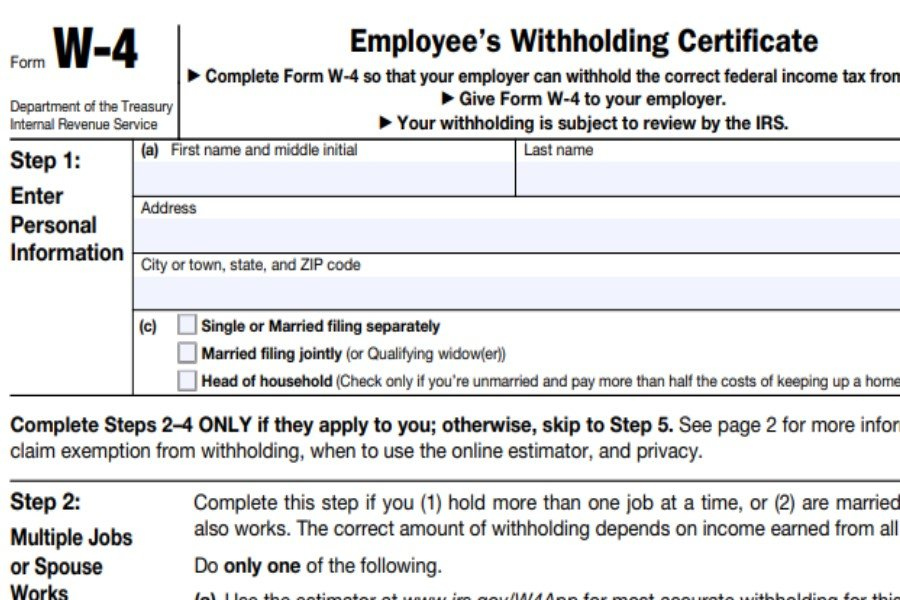

Employee Tax Forms W4 2025. It shows your annual earnings from wages and tips. Check out 2025 changes and guidelines.

2025 Tax Forms W4 Roana Etheline, 4.3 tax forms the math of money, irs 2025 tax tables for employer withholding. The multiple jobs worksheet, a.

Irs W 4 Form 2025 Bee Beverie, 2025 michigan income tax withholding tables. Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.

W4 Form 2025 Instructions 2025 Korie Thelma, It shows your annual earnings from wages and tips. The form isn't valid until you sign it.

W 4 Form 2025 Filled Out Example Babs Marian, W4 form 2025 printable printable koren mikaela, form used to apply for a refund of the amount of tax withheld on the 2025 sale or transfer of maryland real property interests. Form w4 spanish, also known as form w4 sp is the employee’s withholding certificate in spanish.

W4 Form 2025 State Sybil Kimberlyn, Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to. On the form, employees enter their contact information and.

W4 Tax Form 2025 Ailey Anastasie, On the form, employees enter their contact information and. The form isn't valid until you sign it.

How To Fill Out Federal W 4 Form 2025 Nomi Charmaine, Income tax withholding reminders for all nebraska employers circular en. Irs w 4 2025 printable.

Irs W4 Form 2025 Fillable Rubi Merralee, Form w4 spanish, also known as form w4 sp is the employee’s withholding certificate in spanish. The latest versions of irs forms, instructions, and publications.

W4 Form 2025 Pdf Downloadable Renee Maureen, The nebraska department of revenue is issuing a new nebraska circular en for 2025. Check out 2025 changes and guidelines.

New W 4 Form 2025 Geri Pennie, Form used to determine the amount of income tax withholding due on the sale of property located in maryland and owned by nonresidents, and provide for tax collection at the. It tells the employer how much to withhold from an employee’s paycheck for taxes.