403 B Limits 2025. You can tuck quite a bit away into your 403 (b) plan, but the irs does set limits to how. This contribution limit increases to $23,000 in 2025.

403 (b) contribution limits are the. In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their.

The 2025 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

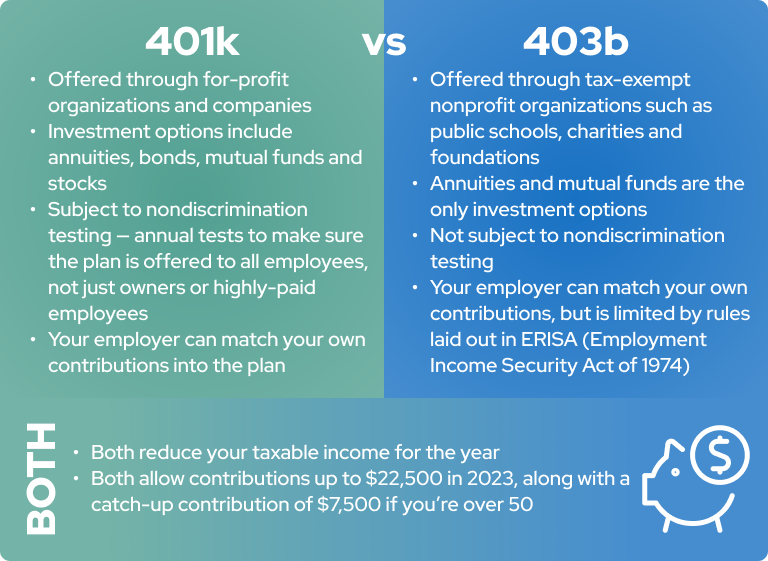

A Comprehensive Guide To A 403b vs. 401k (2025), What are the 403(b) contribution limits for 2025? The contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's thrift savings plan, is increased to.

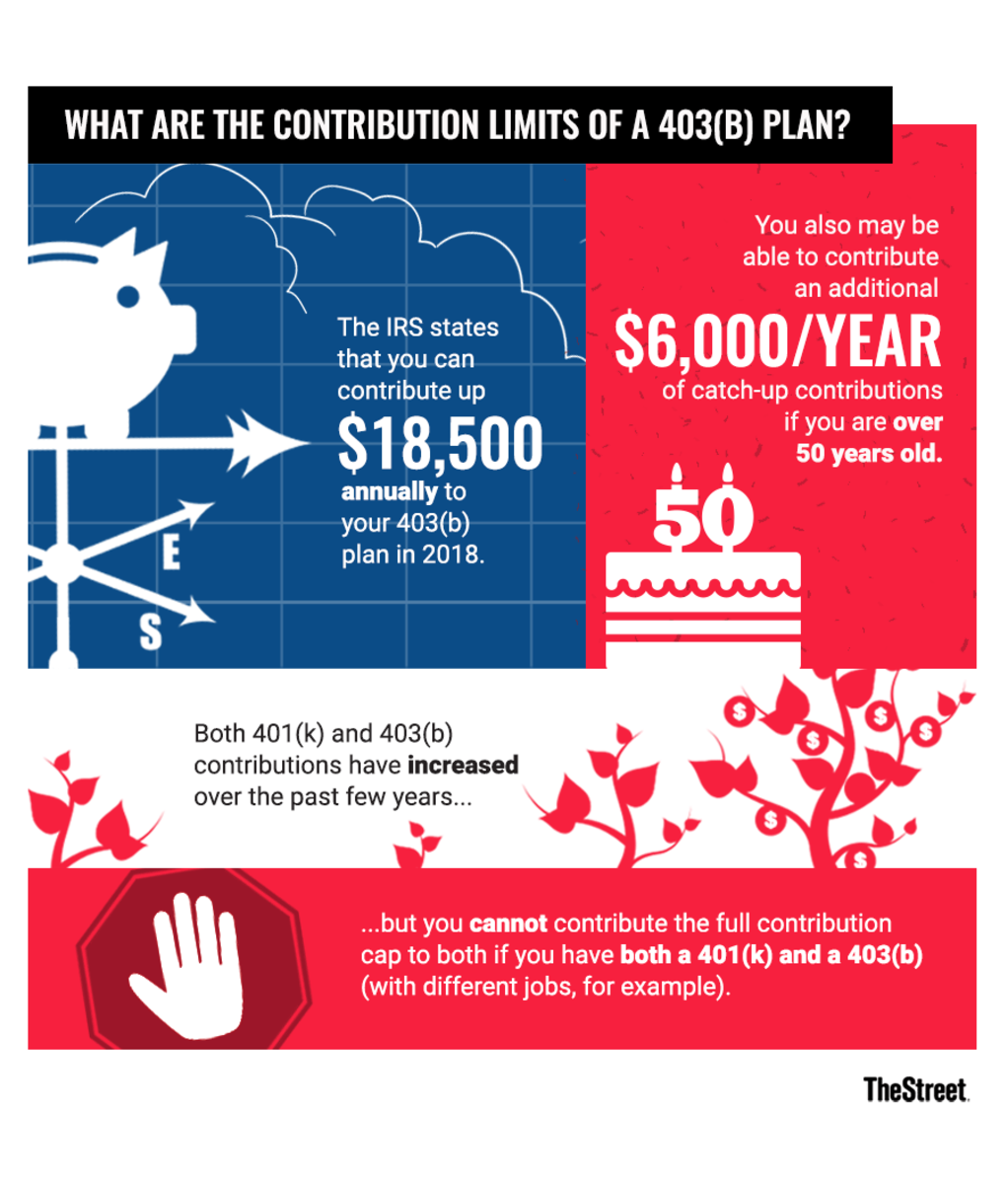

What Is a 403(b) Plan and How Do You Contribute? TheStreet, The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year. Markets open in 1 hour 20 minutes.

A Comprehensive Guide To A 403b vs. 401k (2025), The contribution limit for individuals engaged in 401 (k), 403 (b), and the majority of 457 plans, along with the federal government’s thrift savings plan, has been. A distribution to a domestic abuse victim is a distribution made from your 403 (b) plan (or other applicable eligible retirement plan) that is no greater than $10,000 (indexed for.

403(b) Plan Eligibility, Contribution Limits, Withdrawal Rules & How, On your end, you can defer up to $23,000 from your salary. The extra $500 amounts to about $23 per.

403(b) Retirement Plans TaxSheltered Annuity Plans, Workers can contribute up to $23,000 of their income to a 403 (b) plan, with an additional $7,500 allowed for workers 50 and older. The contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's thrift savings plan is increased to.

403(b) Plan Workest, This type of plan is. The contribution limit for 403(b) plans is $23,000 in 2025 for workers under age 50, up $500 from $22,500 in 2025.

IRS sets 2019 contribution limits for 403(b) plans Hub, This contribution limit increases to $23,000 in 2025. The contribution limit for individuals engaged in 401 (k), 403 (b), and the majority of 457 plans, along with the federal government’s thrift savings plan, has been.

New HSA/HDHP Limits for 2025 Miller Johnson, The contribution limit for employees who participate in 401 (k), 403 (b), and most 457 plans, as well as the federal government's thrift savings plan is increased to. The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2025 to $23,000 in 2025 (compare that to the.

IRS sets 2025 contribution limits for 403(b) plans Hub, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. The internal revenue service recently announced the annual 403 (b) limits for 2025.

PPT 403(b) Retirement Plan Compliance PowerPoint Presentation, free, On your end, you can defer up to $23,000 from your salary. What are the 403(b) contribution limits for 2025?